The Future History of Political Economy – Part 2

by Eric Zencey

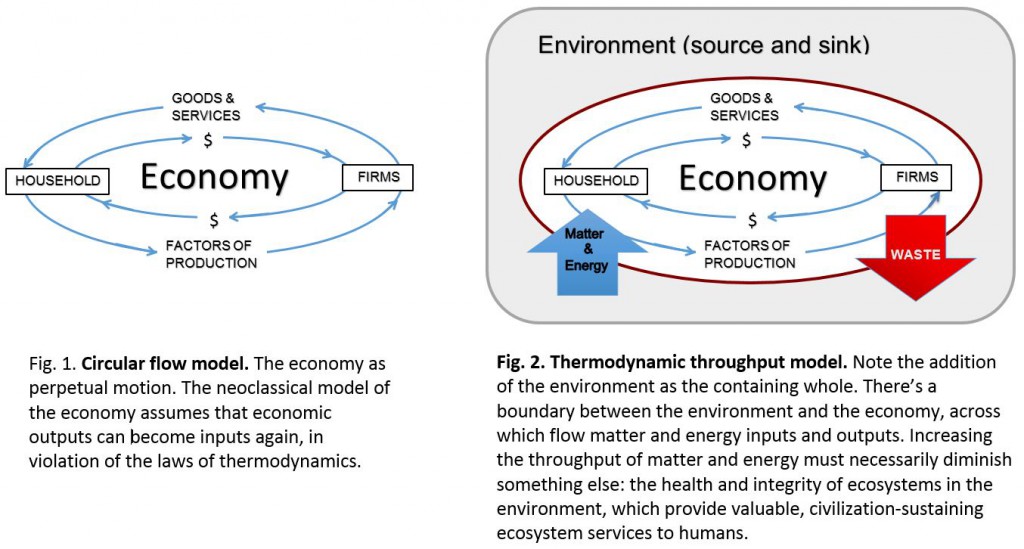

Ecological Economics represents the extension into economics of the thermodynamic revolution of the nineteenth and twentieth centuries. In physics, that revolution dethroned Newton and brought relativity. In biology, it was midwife to the birth of ecology, the study of ecosystems as wholes in which energy networks—food webs—are a defining structure. In chemistry the laws of thermodynamics brought clarity and rigor to a science that struggled to bring theoretical unity to diverse phenomena. So far, though, most economists are perfectly willing to treat their subject matter as if the laws of thermodynamics simply don’t apply to it.

But the thermodynamic revolution in economics can’t be permanently forestalled. For one thing, it’s getting harder and harder for the neoclassical model to reassure us that its system of Newtonian abstractions is a good fit to the real world. The Great Collapse of 2008 demonstrated that whatever else it is, the discipline of economics isn’t very good at predicting major economic phenomena. Climate change and the Sixth Extinction make it hard for economics to maintain its pretense that economic activity takes place in abstractia, on the clean white pages of textbooks or on whiteboards holding formulae, with no roots in or consequences for anything outside of itself. Truths derived on the model of Newtonian mechanism are supposed to be abstract and ahistorical, but our planet and our economy are most assuredly evolving concretely and over time.

The driving dynamic of this economic and planetary change—the driver of history for the past three centuries—has been human use of high-EROI fossil fuel. The driving dynamic of the history yet to come will be the declining EROI of our civilization’s energy sources.

Oil used to gush out of the ground under pressure, making for a very high Energy Return on Energy Invested (EROI). In the 1920s, wells like this gave the industry an average EROI of 100 to 1 or more. Today’s petroleum industry has a much lower EROI. (Credit: Texas State Archives)

You can see some of the consequences of declining EROI already:

- Despite a rising real per capita GDP, for a significant percentage of workers in OECD nations personal income has flatlined or is declining. An increasing concentration of income helps explain this but another dynamic is at work as well. As EROI falls, it takes more economic effort to get the energy that’s needed to support economic effort. Even as gross economic activity (GDP) grows, production of net benefit is shrinking.

- Other sectors of the economy have been affected by this ongoing increase in the economy’s matter-and-energy overhead. “Austerity” has become the watchword for governmental budgets, even in the wealthiest nations in the world. Developed countries find it increasingly difficult if not impossible to pay maintenance and upgrade costs on infrastructure investments made in the heyday of 100-to-1 oil.

- In its 2013 report card on America’s infrastructure, The American Society of Civil Engineers estimated that the U.S. needs to invest $3.6 trillion over seven years to restore and maintain existing infrastructure.

- Worldwide, many of the ecosystems that support human civilization are degraded and close to collapse. Forced by both ideology and declining EROI into austerity budgeting, governments are reducing their scope and energy at the exact moment that sustainability would have them take strong action to rein in the rational, free-market tendency of corporations to maximize profits by degrading the commons and externalizing other costs.

- Pension-fund wipeouts are becoming common as one way to fulfill the economy’s structural need for debt repudiation—a need that lies in our system’s willingness to let debt grow faster than a declining EROI economy can pay back, even after growth has been stimulated by lifting or reducing regulations that limit the environmental damage done by economic activity.

- The planetary carbon sink is full, producing climatic effects that even an abstraction-inhabiting, arithmo-morphizing economist has to acknowledge as a troubling reality.

Centuries from now economic historians are likely to understand the relationship between EROI and wealth creation much better than does the average economist of today. I think it likely that future political economists will express wonder not at the 20th century’s enormous economic success, but at how little we actually added to our stock of wealth for all the high-EROI coal and oil it was our pleasure to burn. They are almost certain to shake their heads in wonder that we, enjoying an energy supply and an EROI never seen on the planet before or since, could ever have experienced an economic downturn, could ever have let a human starve from want, could ever have been so programmatically blind to the physical origins of our fortunes.

What matters most is the matching of available resources to population. On that basis, peak oil happened in 1981 — because that is when per capita oil production peaked.

It takes a special kind of indoctrination to think that economics is not determined by the “laws” of physics, chemistry and biology. I often wondered what went on in schools of economics… A while ago, I found out:

http://users.eastlink.ca/~bxs/Jessica.html

Unfortunately, the prevailing powers of the modern world are all singing the same totally wrong economic song. Here is my song (to the tune of “Four Strong Winds”):

Fossil oil gushing quickly, economies go sky high

We dream things will always be that way

Now our good growth has all gone, population’s moving on

Still we wonder, how it ended up this way.

An age of reason an’ science, made us think that we were wise

Things just kept getting better by each new day

Big engines turn’d big wheels, life becomes an easy deal

What made us think it would always be that way?

Fossil oil gushing quickly, economies go sky high

We dream things will always be that way

Now our good growth has all gone, population’s moving on

Still we wonder, how it ended up this way

Understanding cause and effect, that was inconvenient

Population started growing oh so fast

Some said nature can’t sustain, all this economic gain

And they’ve tried to tell us it could never last

Fossil oil gushing quickly, economies go sky high

We dream things will always be that fine

Now our good growth has all gone, and the good time passing on

We never thought it would end up in decline

Yes our good times are all gone, and we’re bound for moving on

We never thought it would end up in decline

Although folks find the analogy between cancer and humans offputting – it is an appropriate one in that cancer keeps growing until it kills its host, its life support system, then it dies as well … before it reaches end stage, it produces unpleasant symptoms – if diagnosed and treated early enough, the host may be spared … if cancer would just find a niche in the host and only grow to a certain point, it might be able to co-exist with its host indefinitely – and there are some indolent forms that do that for a much longer time than others – but for the aggressive ones, the ones that insist on perpetually growing and invading throughout the host, the end is quite predictable …. This idea no one argues with – so why isn’t it obvious to all that we cannot have endless growth on a finite planet …

Brian, good points.

Not to quibble, but US crude oil production per capita peaked in 1970 and is down 40-45% since, which not coincidentally occurred with the onset of deindistrialization and financialization, and feminization of the the economy and labor force (with the financialized sectors of gov’t, health care, education, financial services, and retail being 65% to 80-85% female employees) since the 1970s-80s.

Financialization resulted in a record low for wages to GDP, falling productivity as a result, unprecedented private and public debt to wages and GDP, and extreme inequality.

The more central banks encourage levering up financial assets to overvalued levels to wages and GDP, and the longer wages to GDP remain at a record low, the higher the rentier claims on wages, profits, and gov’t receipts, and the longer “secular stagnation” will persist with the predictable results.

The Fed eCONomists’ “wealth effect” has become a “rentier claim effect” on the non-financialized sectors of the economy forever.

BC,

Yes, you are dead right about the USA. My comment was based upon global oil production and global population.

It is probably not a coincidence that at the same time (1980’s) there began a big push for globalization…

Eric’s article makes a lot of common sense to me. My intention was to back up his basic point.

Eric and Brian S,

Very well said.

The challenge however is, developed nations are pushing the burden of using more OIL and Coal to produce products that they want to consume onto China and India and that is worrisome, as this invariably increases use of energy (inefficiently) in these countries. There has to be a global push towards reducing aggregate energy consumption quarter on quarter. No amount of alternative energy will be enough for the levels of energy consumption in a classical industrial economy. We must reduce (not just improve the energy efficiency of a gadget) the energy use by order (s) of magnitude if we have to contain the un intended and un wanted side effects of energy use.

Eric’s final paragraph suggests that, centuries from now, there will still be economists explaining why the human race in the 21st century could not have seen that the economics which seemed to have been beneficial to mankind in the 20th century had apparently “stopped working”. I think it is a very optimistic assumption that life as we know it today will be possible and that economists will be a luxury which we will not be able to afford because those of us who are left will be concerned only with survival. Even this will only be possible if we do something about stabilising global population in this century.

I strongly believe that Aquifer’s analogy of cancerous growth and humans is very valid, in that any nation who tries to provide social services to a growing population in the face of diminishing availability of energy, food and water will be just like a host afflicted by cancer. In this case the cancer is in fact the growing population who make ever increasing demands on resources.

This scenario was actually described by an earlier philosopher and economist, Thomas Malthius in the 19th century, but because his predictions did not come true in his lifetime, with the onset of new energy sources and new technologies of the industrial revolution, his predictions were written off by the chattering classes as being “obviously” wrong.

I have no doubt that his predictions were correct, but only the timing estimates were incorrect

Time will tell!

It has always astounded me that conventional economics could arrogantly assume it was not subject to the laws of thermodynamics. Such an attitude should lead to its immediate dismissal particularly in view of the enormous externalities it appears to dismiss with a wave of the hand. This mindless assumption is, of course, a primary reason we are in such trouble today. Imagine the difference if economists had to deal with the reality of the 2nd law whose results now appear everywhere on our degraded planet.

If you have studied thermodynamics in university physics you will realise that the thermodynamic laws are based on energy losses from a system. I know one can argue that the planet is a system, but it is difficult to quantify the extent of the system.

A countries economy is not a closed system. For example, if you look at the breakdown of actual products of an economy, some breakdown products increase entropy and some decrease entropy. It is difficult to imagine applying the strict laws of thermodynamics to such a scenario. It is also difficult to image the laws of thermodynamics applying to such a broad generalisation as ‘the health of a system”. I do think that economists should stop using the laws of thermodynamics to justify broad generalisations and start looking more closely at each instance of where the supposed laws apply. Work out EXACTLY the energy losses in joules, work out EXACTLY the damage to ecosystems by measuring damaging breakdown products such as PPCP’s.

I do think that to institute a SSE globally, we will need to stop thinking in such vague terms, such as trying to misapply the laws of thermodynamics, and start looking at what steps need to be taken to institute global SSE. What EXACT steps, not broad policies. In other words, start thinking like scientists and engineers, because we are trying to engineer the global economy.

If anyone would like to see my tentative steps to a global SSE, please send email request.